Latest Insights

In the dynamic world of entrepreneurship and innovation, the rise of venture studios represents a significant shift in how startups are created and nurtured. This article explores the distinctive advantages that startups raised within venture studios enjoy compared to those following traditional entrepreneurial approaches.

Venture studios, also known as startup studios or company builders, are organizations that systematically build multiple startups from the ground up. Unlike traditional incubators or accelerators, venture studios are deeply involved in the early stages of a startup’s lifecycle, providing not just capital but also operational support, expert guidance, and a suite of shared services. This unique model offers several key advantages for emerging businesses.

As we delve deeper into this article, we will explore these advantages in detail, providing a comprehensive understanding of why venture studio-backed startups are uniquely positioned to thrive in today’s competitive business landscape.

1. Speed – an assembly line is more efficient than manual production

In the innovative realm of startup development, venture studios are transforming the entrepreneurial landscape with their distinct approach. These studios, by structuring methodologies for ideation, Minimum Viable Product (MVP) development, and market launch, significantly expedite the startup process.

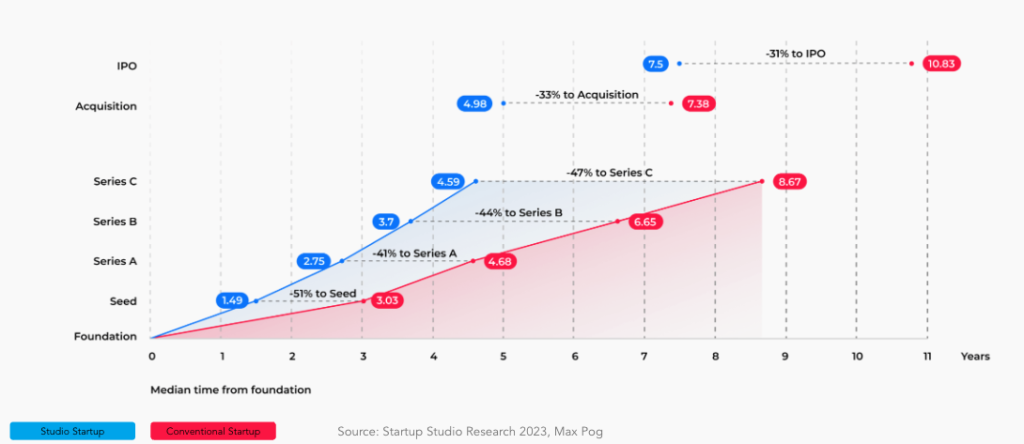

The speed advantage extends further along the funding timeline. Startups from venture studios reach Series A funding 41% faster (2.75 years vs 4.68 years), Series B 44% quicker (3.7 years vs 6.65 years), and attain Series C funding 47% faster (4.59 years vs 8.67 years).

2. Faster exits

In a study encompassing 182 acquisitions and 22 IPOs of studio startups, it’s clear that these companies are reaching significant milestones more rapidly than their non-studio counterparts. Studio startups are typically acquired within 5 years, a 33% faster rate, and achieve IPOs in 7.5 years, reducing the time by 31%.

A standout success story is Science Inc.’s Dollar Shave Club, which Unilever acquired for $1 billion after just five years of growth. Another notable example is Liquid Death, founded in 2017 and reaching a $700 million valuation by 2022, with IPO plans set for 2024. Additionally, there are cases of exceptionally swift exits, such as Slimmer AI’s startup Biller, which was acquired within just 8 months.

3. Accumulation of industry experience + data sharing among portfolio companies (better than within VC funds)

The launch of a seventh startup in domains like agritech or legaltech is markedly simpler compared to the inaugural venture. By this stage, a wealth of experience has been amassed, including numerous case studies, identification of key problems, and an extensive database of partners and clients. Additionally, essential licenses have been acquired, and vital metrics have been established. This accumulated knowledge and resources enable startups to share data, significantly accelerating the development process for each new venture. The startup studio’s role as an active co-founder facilitates this exchange of information more efficiently than what is typically seen among startups in a VC fund’s portfolio.

4. Savings and sharing of the studio team – 3-4 times cheaper than outsourcing

Startups often don’t require a large number of full-time specialists. While outsourcing tasks such as marketing, design, or development is an option, it’s worth noting that agency specialists can cost three to four times more than in-house staff. Even contractors typically charge a higher hourly rate compared to full-time employees. In this context, a startup studio functions much like having an in-house agency but at a substantially reduced cost, offering an economical alternative to traditional outsourcing.

5. Investment efficiency – higher IRR due to cheaper equity at the start, less dilution at exits, and more frequent exits

Rather than investing $500K for a 10% stake in a startup as an angel investor or pre-seed VC fund (assuming a $5M post-money valuation), consider using that capital to build a company that could be valued at $10M in 18 months, while securing a 25% stake. This approach potentially results in a 5x Total Value to Paid-In (TVPI) ratio.

Equally significant is the potential to maintain this stake through successive funding rounds until exit. Take the example of Snowflake’s notable IPO, where it reached a $70B market cap. Sutter Hill Ventures retained over 20% ownership because they incubated the company from the start and consistently co-invested during its growth.

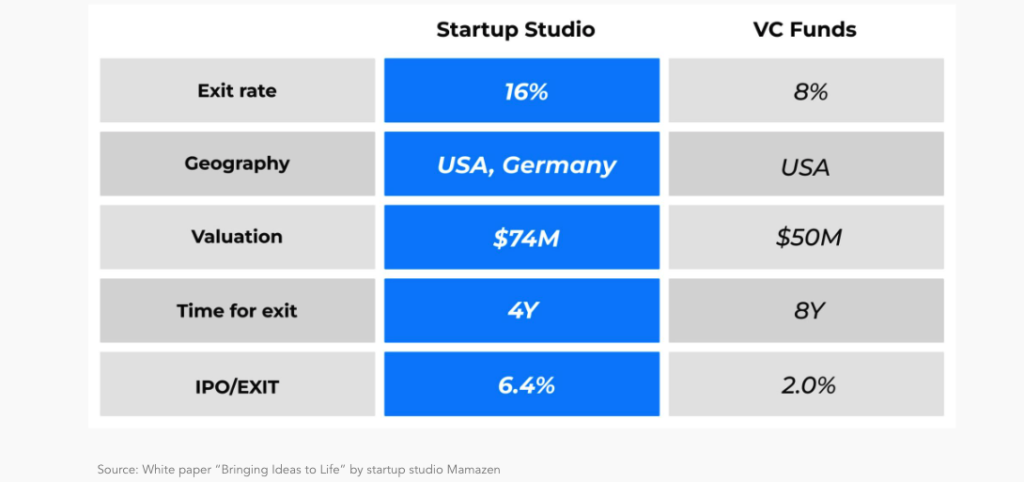

This is supported by findings from Mamazen’s white paper “Bringing Ideas to Life.” In 2020, a study comparing 186 studio-generated startups with 607 VC-funded startups found significant differences in performance, measured by valuation at exit and the time from foundation to exit.

6. Reduced risks due to the ability to test multiple ideas and quickly discard the ones that don’t work

Venture studios excel in sifting through hundreds of ideas, discarding the less viable ones and honing in on the most promising. A prime example is IdeaLab, often considered the pioneer of the startup studio model. They evaluated over 5000 ideas, leading to the creation of over 150 companies and an impressive tally of more than 50 successful exits.

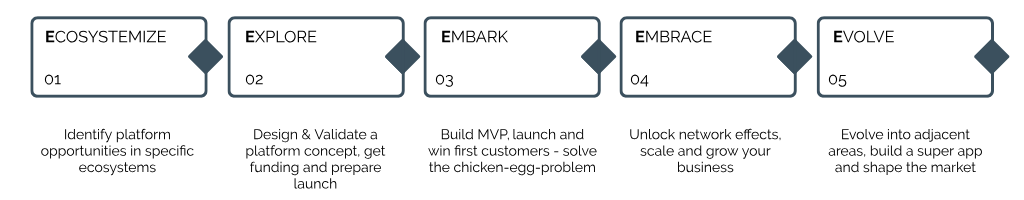

A common practice among many studios is the implementation of the stage-gate model in their operations. This approach involves multiple checkpoints that grant access to further funding and developmental processes. Should an idea receive a “red light” at any stage, indicating it’s not feasible or promising enough, investment is halted, and focus promptly shifts to exploring the next potential concept.

The 5E stage gate process by fastbreak.one to build and scale platforms & marketplaces

7. Entrepreneurs can dedicate more time to core business tasks

Entrepreneurs within venture studios benefit from being able to focus more on their core business activities. The studios take care of the routine tasks and provide industry expertise along with marketing and development teams. This support helps startups achieve product-market fit more quickly. Founders don’t need to get bogged down in administrative tasks such as company registration, drafting initial client contracts, establishing domain emails, bookkeeping, hiring contractors, or spending 3-6 months on pre-seed and seed fundraising. Instead, they can direct their energies towards launching, sales, conducting client interviews, product development, and scaling their business.

8. Networking opportunities comparable to accelerators and VC Funds

Venture studios boast a vast network of investors and entrepreneurs, providing a significant advantage over regular entrepreneurs who often lack these connections. This extensive network not only facilitates easier access to investment rounds but also helps in attracting strategic partners, a task that can be more challenging for entrepreneurs without such established relationships.

9. Psychological compatibility – parallel entrepreneurship instead of serial

Bill Gross, the founder of IdeaLab, revolutionized the traditional approach to entrepreneurship. Instead of the conventional cycle of creating one company, selling it, and then starting another, Gross envisioned a model where multiple companies could be developed simultaneously. This innovative thinking led to the creation of the world’s first startup studio, introducing the concept of parallel entrepreneurship.

Jack Abraham further elaborates on this idea, suggesting that the most intelligent individuals typically align with one of two approaches: either they are intensely focused on a single project, striving to excel in it, or they thrive on engaging with a variety of projects and people, drawing energy from the excitement of turning multiple ideas into reality (the zero-to-one process). This dichotomy highlights the diverse nature of entrepreneurial spirit and the varying paths to success and innovation in the business world.

Conclusion:

In conclusion, the startup studio model offers a plethora of advantages that are reshaping the landscape of entrepreneurship. These benefits include:

Risk Mitigation: Venture studios significantly reduce the inherent risks of startups by offering expert guidance and operational support, leading to a higher success rate.

Access to Networks: Startups in studios gain immediate access to a wealth of connections, including seasoned entrepreneurs, industry experts, and investors, which is crucial for mentorship and growth.

Speed of Development: With shared resources and expertise, startups in studios can rapidly scale and develop, focusing more on core product development than administrative tasks.

Funding Efficiency: The model demonstrates greater efficiency in funding, with startups in studios often reaching funding milestones more quickly and maintaining significant stakes through successive rounds.

Resource Optimization: Studios allow startups to share valuable data and resources, leading to faster development and reduced costs compared to traditional startup models.

In-House Expertise: Acting like an internal agency, studios provide cost-effective access to specialists in areas like marketing, design, and development.

Idea Validation: Studios excel in filtering and validating ideas, employing models like the stage-gate process to focus on the most promising ventures.

Entrepreneurial Focus: Founders can concentrate on core activities like product development and scaling, as studios handle routine administrative tasks.

Networking and Investment Opportunities: Studios’ extensive networks offer easier access to investment and strategic partnerships, a distinct advantage over individual entrepreneurs.

Collectively, these advantages illustrate why the startup studio model is an increasingly popular and effective route for entrepreneurs. By providing comprehensive support, resources, and a collaborative environment, venture studios are not just incubators of ideas but powerful catalysts for successful, sustainable business growth.

Fastbreak.one stands at the forefront of assisting companies in navigating these complex ecosystems. Our expertise in building and scaling digital platform businesses is not just a service; it’s a partnership for transformative growth. We invite you to explore the potential of ecosystem strategies with us, embarking on a journey toward digital excellence and market leadership.

Below you will find further insights from our work with organizations around the globe to launch and scale businesses based on network effects and a positive impact to our society.

Business Building

B2B Platforms

Toolkits & Frameworks

Please share & subscribe

If you like our articles, please share in your social media and subscribe to our bi-weekly newsletter.